Bybit Hack Marks the Largest Crypto Heist in History: How Can I Save ETH Safely?

In an unprecedented breach, the Bybit Hack has sent shockwaves through the cryptocurrency world, with losses estimated at $1.5 billion—making it one of the largest crypto heists in history. As millions of dollars were stolen and investigations continue, the hack has raised serious concerns about the security practices of crypto exchanges and how individuals can better protect their digital assets. With the dust still settling, one crucial question remains: How can you securely store your ETH in the wake of such a devastating attack? In this article, WEEX will explore the Bybit Hack, its far-reaching consequences, and provide practical tips on safeguarding your ETH and other assets, particularly for those holding Bybit Token or the Bybit native token.

The Bybit Hack: The Largest Crypto Heist in History

The Bybit Hack involved a sophisticated attack on the platform, which resulted in the loss of a massive amount of funds. The hack compromised users' wallets, and the stolen assets included both Bybit coin and various cryptocurrencies like ETH USDT. This attack, believed to be carried out by advanced hackers, has shocked the industry due to its scale and precision.

As one of the leading exchanges globally, Bybit’s security breach has caused concern among its millions of users, and many are now reconsidering how and where to store their crypto assets. The incident underscores the vulnerabilities inherent in centralized exchanges and serves as a wake-up call to the broader crypto community.

What Happened During the Bybit Hack?

During the Bybit hack, attackers were able to breach the exchange’s security systems, gaining unauthorized access to Bybit tokens and customer wallets. The Bybit token name was also targeted, and large amounts of Bybit native token were siphoned off. As a result, many users were left scrambling to secure their remaining funds and assess the impact of the breach.

The attack has raised questions about the exchange’s security protocols, highlighting the importance of safeguarding assets in a volatile and high-risk market. Although Bybit has committed to reimbursing users who were affected by the hack, the breach has underscored the growing need for users to take control of their own security measures, especially when it comes to storing ETH and other tokens.

How Can I Save ETH Safely After the Bybit Hack?

After the Bybit hack, it is crucial to rethink how you store and manage your Ethereum (ETH) and other crypto assets. Here are some essential strategies to keep your ETH safe:

1. Use Hardware Wallets for Secure Storage

Hardware wallets like the Ledger Nano S or Trezor provide offline storage for your ETH and other cryptocurrencies. This method ensures your assets are kept far from online threats like hacks or phishing attacks, offering the highest level of security.

2. Enable Two-Factor Authentication (2FA)

Always enable 2FA on your exchange accounts, including Bybit. While it won't prevent a hack on the exchange's servers, it can add an extra layer of security to your personal account. Use an authenticator app (Google Authenticator or Authy) rather than SMS-based 2FA for better protection.

3. Store ETH in Decentralized Wallets

Consider storing your ETH in decentralized wallets such as MetaMask or Trust Wallet. These wallets give you complete control over your private keys, ensuring your assets are safe even if an exchange like Bybit gets hacked.

4. Withdraw Your Funds to a Secure Wallet

If you’re holding large amounts of ETH or Bybit coin, it's recommended to withdraw your funds to a personal wallet that you control. Bybit’s native token and other assets should only remain in exchange wallets for trading purposes, and only in small amounts.

5. Stay Vigilant and Avoid Phishing Attacks

After a major hack like the Bybit hack, phishing attacks targeting users are more common. Be cautious about unsolicited emails, fake websites, and other scams. Always double-check the URL and make sure you're logging into the correct platform.

6. Consider Storing ETH on Multiple Platforms

For added security, consider diversifying the storage of your ETH across multiple wallets or platforms. This will reduce the risk of losing all your assets if one platform is compromised, offering a level of redundancy.

How to Spot Suspicious Transactions Like the Bybit Hack

It’s crucial for crypto users to be vigilant in monitoring their assets. Here are key red flags to watch for:

- Unusual Wallet Activity: Sudden large withdrawals, such as a $1.5 billion outflow in minutes, are a major red flag.

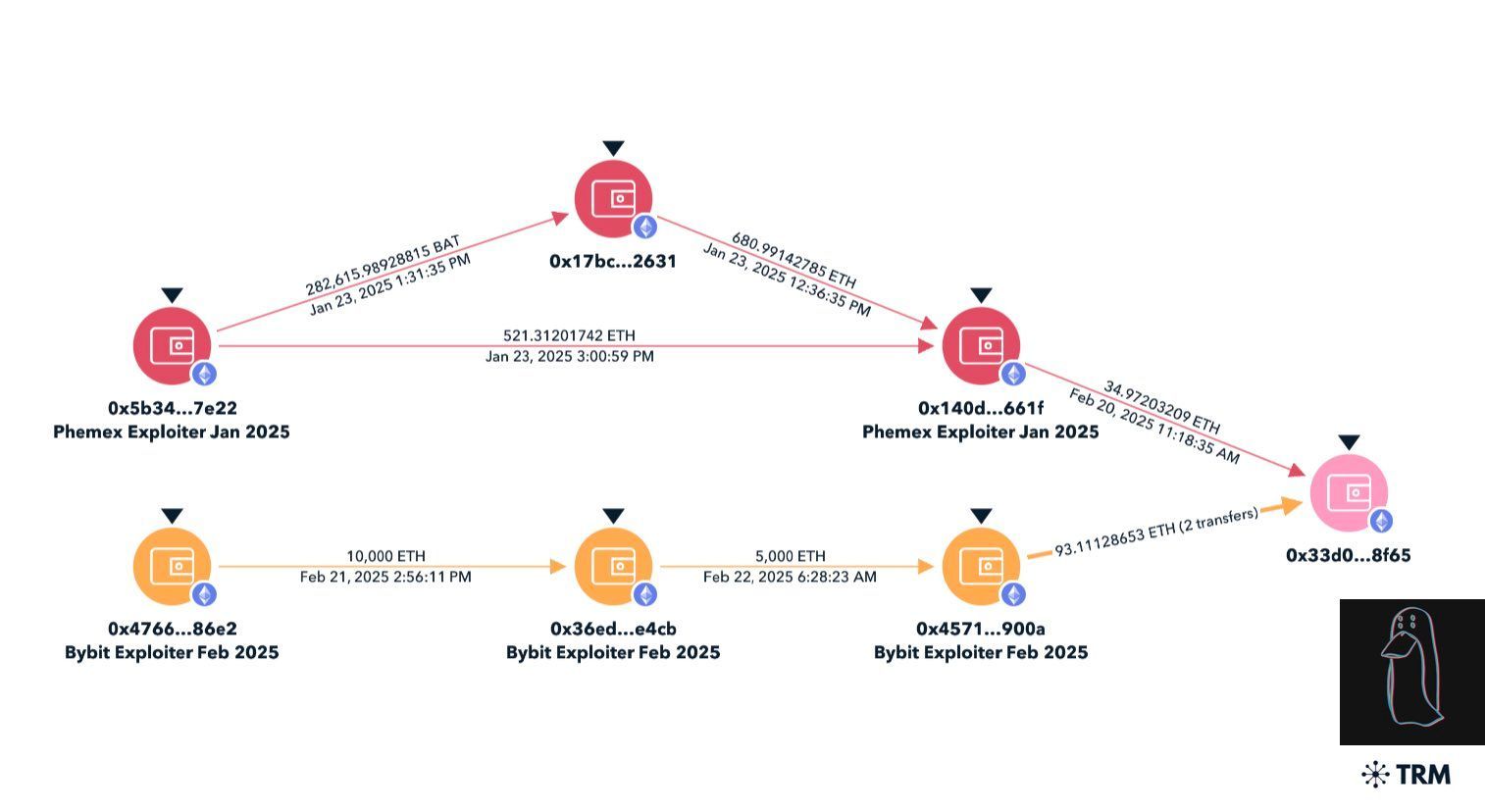

- High-Frequency Transfers: Hackers often split stolen funds into smaller amounts and move them across numerous wallets as part of a laundering tactic.

- Interaction with Mixers: Watch for transactions routed through privacy tools like Tornado Cash or Wasabi Wallet, which are often used to obscure the origins of stolen funds.

- Mismatched Timestamps: Transactions occurring during off-peak hours or low-traffic periods could be an attempt to avoid scrutiny.

- Smart Contract Anomalies: Unverified contracts that are receiving or draining funds can be a sign of malicious activity.

Tools to Monitor Transactions

To stay ahead of potential threats, use these tools to track and monitor suspicious activity:

- Blockchain Explorers: Platforms like Etherscan or BscScan allow you to track the movement of ETH and Bybit Token (BIT) on the blockchain.

- Alert Systems: Set up notifications for large wallet movements using services like Whale Alert, which notifies you about high-value transactions.

- Risk Assessment Platforms: Use tools like Chainalysis or TRM Labs to screen addresses for illicit links and suspicious activity.

How Does the Bybit Hack Affect the Bybit Token?

With the massive loss of Bybit tokens in the hack, the price of the Bybit native token has experienced volatility. The value of Bybit coin has been under pressure as traders and users move their funds off the exchange in light of the security breach. However, Bybit has assured its community that they are working to resolve the issue and strengthen their security measures.

Despite this assurance, the hack has prompted many crypto investors to reconsider their reliance on centralized exchanges like Bybit for long-term holdings. Users are now more inclined to secure their Bybit coin and other assets by transferring them to private wallets or decentralized exchanges.

Why This Hack is a Wake-Up Call for Crypto Users

The Bybit Hack is a significant reminder of the risks involved in crypto trading, especially when assets are stored on centralized exchanges. While exchanges like Bybit provide convenience and liquidity, they also pose a risk to users who leave their funds on the platform for extended periods.

As the hack demonstrates, users must take proactive steps to safeguard their digital assets, especially high-value tokens like ETH and Bybit coin. Utilizing personal wallets, setting up robust security protocols, and staying informed about the latest threats are critical steps in protecting your investments in the volatile world of cryptocurrency.

Conclusion: Take Control of Your Crypto Security Today

In the aftermath of the Bybit hack, it's more important than ever to understand the risks associated with storing ETH and other tokens on centralized exchanges. By following the tips above, you can take control of your digital assets and safeguard them against future hacks. Whether you're holding Bybit tokens, ETH, or Bybit native token, securing your assets is crucial to ensuring they remain safe in the long term.

Be sure to explore hardware wallets, decentralized options, and never leave your assets exposed. Stay informed about the latest developments from Bybit and the crypto world, and always prioritize security when dealing with your digital wealth.

Stay safe, stay secure, and trade with peace of mind.

You may also like

How to Make Money in Crypto in 2026? 4 Main Methods Explained

This guide breaks down the four main methods that are helping thousands of people earn in crypto right now. We'll focus especially on two popular approaches offered by leading platforms: WEEX Auto Earn for stablecoins and WEEX Staking for various cryptocurrencies.

PURCH Coin Price Prediction & Forecasts for February 2026: Fresh Listing Sparks Potential Rally

PURCH Coin has just hit the scene with its listing on WEEX Exchange today, February 2, 2026, opening…

How to Buy Your First Bitcoin Safely in 2026: Complete Beginner's Anti-Scam Guide

Before buying anything, you should know what you're investing in. What is bitcoin? It's digital money that works without banks or governments. Think of it as "digital gold" that you can send anywhere in the world, anytime. Only 21 million will ever exist, which makes it valuable like rare metals.

What Makes an AI Trading Bot for Crypto Stand Out: Lessons from WEEX’s Innovations

As of February 2, 2026, the crypto world is buzzing with advancements in AI trading bots, especially with…

What is CLAWNCH (CLAWNCH) Coin?

We are thrilled to announce that the trading pair CLAWNCH/USDT is now available on WEEX, with trading having…

CLAWNCH USDT Trading Debuts on WEEX: CLAWNCH Coin Listed

WEEX Exchange is thrilled to announce the listing of CLAWNCH Coin (CLAWNCH), a promising token on the Base…

CLAWNCH Coin Price Prediction & Forecasts for February 2026: Potential Rally as Base Network Adoption Grows

CLAWNCH Coin has just hit the scene, launching on the Base network on January 31, 2026, with a…

BNB 2026 Value Forecast: Assessing the Resilience of the Binance Ecosystem

Explore the expert BNB price forecast for 2026 and a deep dive into the Binance ecosystem's long-term sustainability. This analysis covers opBNB technical milestones, institutional outlooks from $850 to $2100, and strategic investment insights for the post-CZ era.

Avalanche (AVAX) 2026 Outlook: Is This the Most Undervalued Institutional Public Chain?

Explore why Avalanche (AVAX) is positioned as the most undervalued institutional public chain in 2026. Discover how its Subnet architecture and RWA leadership are redefining the future of digital finance.

Will Stablecoins Replace Traditional Payments in 2026? USDT and USDC Latest Trends

With the stablecoin market cap exceeding $305 billion, will they finally replace traditional payments in 2026? This report analyzes the latest USDT vs. USDC trends, institutional adoption, and the rise of AI-driven on-chain settlements.

Polymarket Alternatives: 2026 Prediction Market Outlook

Explore the 2026 prediction market landscape as Polymarket faces fierce competition from Kalshi, Robinhood, and Opinion. Discover which platform offers the best accuracy, how decentralized intelligence is replacing traditional media, and the key alternatives for crypto investors in this 2026 outlook.

Asset Tokenization 2026: How Close are Stocks, Bonds, and Real Estate to the Blockchain?

Explore the Asset Tokenization 2026 landscape. Learn how stocks, bonds, and real estate are moving on-chain with SEC compliance and AI agents. See the latest RWA data and market trends for 2026.

2026 Crypto Scam Guide: Protecting Assets in the AI & Web3 Era

Stay safe in 2026 with our comprehensive Crypto Scam guide. Learn to identify AI-driven traps, romance scams, and honeypots. Discover how secure platforms like WEEX protect your Web3 assets.

Private Key, Mnemonic, and Seed Phrase: Comprehensive 2026 Recovery & Security Guide

Private Key, Mnemonic, and Seed Phrase lost or compromised? Discover what they are and follow our 2026 expert recovery protocol to restore access. Secure your assets now!

2026 Cryptocurrency Tax Reporting: How to Report Crypto Taxes in 2026? China / Japan / Global Users Must-Read

2026 crypto tax reporting explained for China, Japan & global users. Learn CARF rules, filing steps, deadlines & real examples. Get compliant — explore now.

What is Kindred Labs (KIN) Coin

The world of cryptocurrency is buzzing with exciting news as Kindred Labs (KIN) Coin is now officially listed…

KIN USDT Pair Debuts on WEEX with Kindred Labs (KIN) Coin

WEEX Exchange is thrilled to announce the listing of Kindred Labs (KIN) coin, opening up KIN/USDT spot trading…

What is OpenClaw (OPENCLAW) Coin?

Today, we’re thrilled to bring you an insight into OpenClaw (OPENCLAW), a promising addition to the crypto world…

How to Make Money in Crypto in 2026? 4 Main Methods Explained

This guide breaks down the four main methods that are helping thousands of people earn in crypto right now. We'll focus especially on two popular approaches offered by leading platforms: WEEX Auto Earn for stablecoins and WEEX Staking for various cryptocurrencies.

PURCH Coin Price Prediction & Forecasts for February 2026: Fresh Listing Sparks Potential Rally

PURCH Coin has just hit the scene with its listing on WEEX Exchange today, February 2, 2026, opening…

How to Buy Your First Bitcoin Safely in 2026: Complete Beginner's Anti-Scam Guide

Before buying anything, you should know what you're investing in. What is bitcoin? It's digital money that works without banks or governments. Think of it as "digital gold" that you can send anywhere in the world, anytime. Only 21 million will ever exist, which makes it valuable like rare metals.

What Makes an AI Trading Bot for Crypto Stand Out: Lessons from WEEX’s Innovations

As of February 2, 2026, the crypto world is buzzing with advancements in AI trading bots, especially with…

What is CLAWNCH (CLAWNCH) Coin?

We are thrilled to announce that the trading pair CLAWNCH/USDT is now available on WEEX, with trading having…

CLAWNCH USDT Trading Debuts on WEEX: CLAWNCH Coin Listed

WEEX Exchange is thrilled to announce the listing of CLAWNCH Coin (CLAWNCH), a promising token on the Base…