With Faker's carrying, he won nearly $3 million dollars

The League of Legends S15 World Championship has come to an end, and Faker once again stood on the highest award podium, claiming his 6th championship title and continuing to write his legend. Meanwhile, in the crypto world, with the rise of prediction markets, players enjoy esports events while participating in the prediction markets.

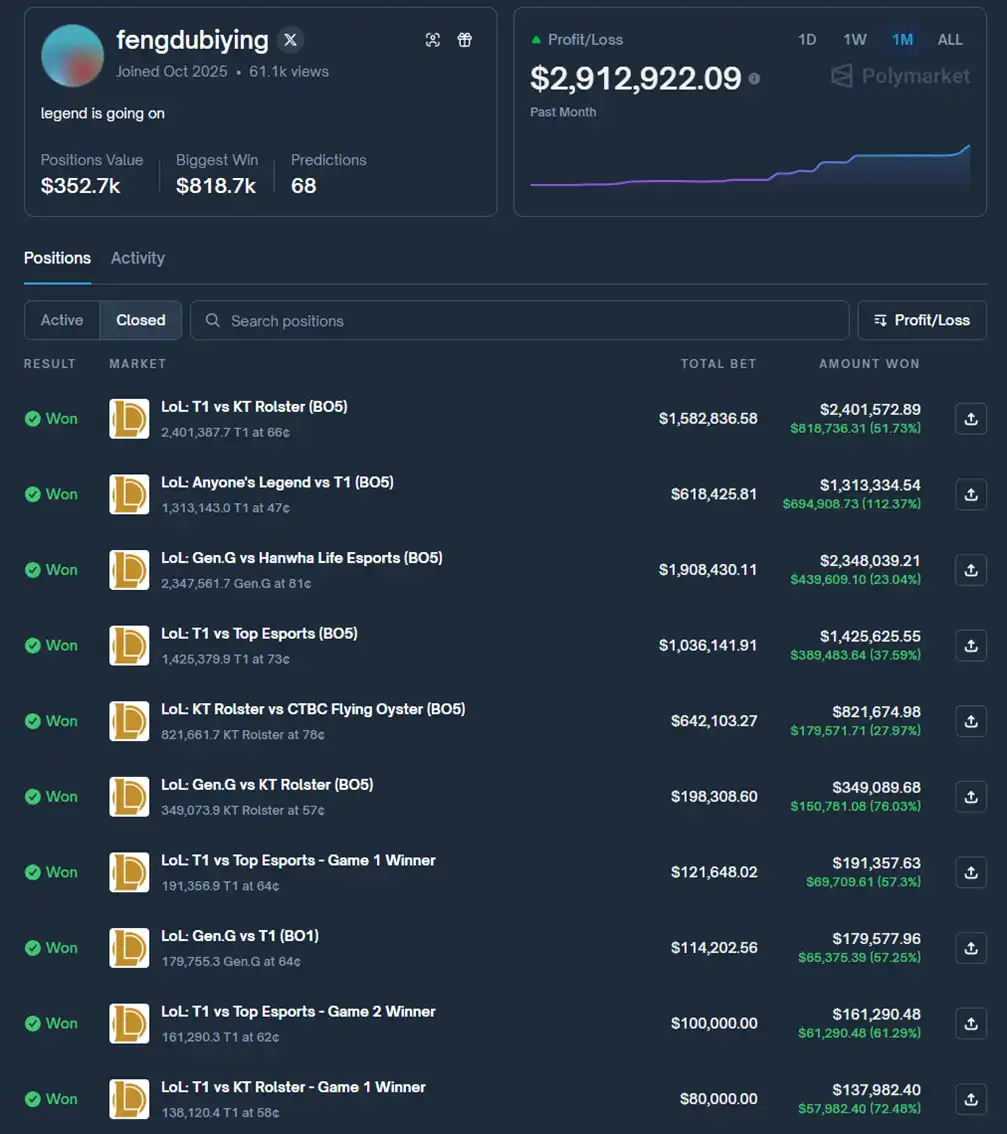

Among the many crypto players participating in prediction markets, an ID named "fengdubiying" has become a new legend. In the final prediction of T1 against KT, he boldly bet around $1.58 million on T1's victory, ultimately earning approximately $820,000 in profit.

Starting from the S15 Swiss round matches, "fengdubiying" began with a $30,000 position. By the end of the S15 finals, his total profit on Polymarket had exceeded $2.9 million. This incredible performance has drawn attention from overseas.

How did he do it? What opportunity prompted him to become active on Polymarket? In his view, what issues does Polymarket and the entire prediction market space currently face, and how should we look to the future? "fengdubiying" sat down with BlockBeats to share his legendary journey and insights with us.

Betting on His Own Perception

"If I feel confident about something, I will bet on it. This has been my strategy since entering the crypto world."

Believing in his own perception and betting large positions on what he considers highly certain is his key to success. During last year's Solana meme market, he achieved a single-coin A8 on moodeng.

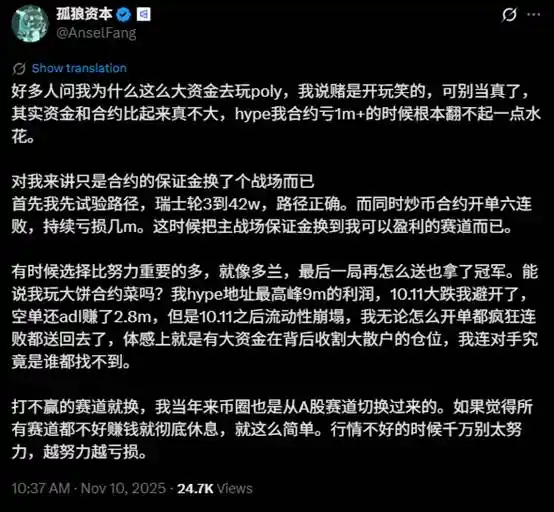

While this strategy may sound simple, it requires a strong heart and confidence. Behind each brilliant moment of victory, there are naturally moments of disappointment. As he wrote on X, his peak profit on Hyperliquid reached $9 million, avoiding the plunge on October 11 and earning $2.8 million through short positions. However, subsequent liquidity collapses led to a series of losses, giving back the profits he had made.

However, as the old man said when he lost his horse, who knows if it was a blessing in disguise? His failure in the futures market led him to profit from a bet on Polymarket predicting Bitcoin to drop below $105,000. Although not a large sum, he turned $13,000 into $30,000, thus embarking on his legendary journey on Polymarket.

Prior to this, when Trump was elected President of the United States, he had already heard about Polymarket and prediction markets. However, as he was not interested in political predictions and felt unsure, he chose not to participate. To explore this new track and potentially receive airdrops, he initially chose to focus on cryptocurrency-related predictions.

Then, an opportunity presented itself—the League of Legends Season 15 World Championship.

Decisiveness and Self-Belief: The League of Legends King of Polymarket

There is no doubt that Faker is the king of League of Legends. Yet, on Polymarket, fengdubiying was crowned with his strong mindset.

Throughout this legendary journey, only player Chovy posed a threat to him. During the KT versus Gen.G semifinals, he bet over $400,000 on Gen.G. However, Chovy's performance in the match left him speechless. When Gen.G fell behind 1-2, he resolutely closed his position in favor of Gen.G and switched to betting on KT.

This move resulted in a loss of $20,000 for him.

When asked about his gaming rank, he humorously replied:

“Actually, I haven't played for a long time. I reached Diamond back when I was in school, but as I got older, I couldn't keep up. Just because someone understands the game doesn't mean they're good at playing it.”

Although he no longer charges into Summoner's Rift holding a mouse like he did in his student days, he never misses the annual Worlds tournament and always makes his own predictions about the results, with a decent win rate.

When asked if he engages in arbitrage based on player mentality fluctuations due to changes in the game’s progress, he said he does not:

“Once you enter the knockout stage, the gap in strength between teams is small, and the situation changes rapidly. If a team is in poor condition and is already behind, they can easily get wiped out in one fell swoop. At that point, there's no space for arbitrage. Betting on Polymarket is similar to opening a futures contract—it’s all about the same principle. There's nothing that's guaranteed; you can only say you're standing on the side with higher probability.”

Differences Between Prediction Markets and Traditional Entertainment

According to fengdubiying, there is a fundamental difference between prediction markets and traditional entertainment:

「The difference between the two is huge. It's like baccarat and Texas hold 'em, where baccarat is player versus banker, and Texas hold 'em is player versus player. In a prediction market, each prediction is a battle between players, relying on their own cognition and strategy. If you choose to play against the banker, you are destined to lose.」

He believes that the prediction market is a variant of a trading market, with limit and market orders, and it charges some fees similar to the futures market.

In terms of the subject scope of prediction markets, he also believes that there is a significant difference from traditional gambling. The subject scope of prediction markets is wide, including traditional sports such as football, basketball, esports, as well as many political and weather-related predictions.

In addition, the prediction market is built on smart contracts, providing unique security and convenience on-chain. Although both prediction markets and traditional entertainment may seem to involve "betting on something," he believes that the prediction market is a completely new track, and the two cannot be compared.

Current Issues in the Prediction Market

In terms of liquidity, fengdubiying believes that there is still much room for improvement in the current prediction market.

「This year I switched to the Bitcoin futures market because other tracks on the market couldn't accommodate the depth of my position. If a track or a market does not have deep enough liquidity, I end up giving money to others. When players reach a certain capital volume, they will clearly feel the limitations of liquidity in various markets and can only go to a place with liquidity that can accommodate their capital volume.」

In his view, Polymarket's current situation is similar to when the meme market first emerged, with low liquidity. Besides world-class sports events and globally significant political and economic topics, the liquidity for many other topics is low. For whales, the actual selection of prediction targets that they can participate in is limited, as going in and out with just a few thousand to tens of thousands of dollars is boring for whales.

He personally experienced the problem of insufficient depth making it difficult to scalp during the process of betting on the S race:

「If you want to bet with a higher position, it is difficult to scalp or set take-profit and stop-loss levels. A position of 200-300k USD is manageable, but when it rises to 800k or even million-dollar levels, it's very hard. When T1 was 1:2 behind, I looked at the order book. If I wanted to set a stop-loss at that time, there was only around 100k USD in orders on the book. Even if I sold to stop-loss at that time, I would only get back this much money.」

He believes that there are many whales much larger than him, and if we want to attract these whales to play in the prediction market, we definitely need better liquidity. If the prediction market can introduce market makers like the derivatives market to increase order book depth, it will be more attractive to whales.

Furthermore, in terms of actual user experience, he believes that all prediction markets on the market still need to improve.

Outlook on the Prediction Market

Before we start discussing the future of the prediction market, we first posed a question to fengdubiying—whenever there was a hot event in the past, there would always be many meme hot pots popping up, such as meme coins revolving around candidates and various sudden events during the previous U.S. election. As the prediction market continues to develop, will there be a competitive situation between the prediction market and meme hot pots?

His answer was decisive:

"In my opinion, the meme track has already ended. The crypto world has always been repeating some similar things, essentially the same, conceptually creating fun. For retail players, the source of expectations comes from encountering a so-called new thing and immediately feeling a new gameplay that was not there before. This kind of situation takes time; for example, during the era of inscriptions, UniSat slowly built up until the second wave truly gained momentum, and the infrastructure was basically complete. From this perspective, after pump.fun, meme coins are no longer fresh, and everything that needs to be built has been built, and no one is taking over. From whales to small holders, everyone will eventually withdraw because they are not making money. Therefore, there is no competition between a track that is already declining and one that is in an upward trend."

In the real world, significant events happen every moment. In his view, although sports and political-economic themes are currently popular on Polymarket, there will definitely be more popular themes in the future.

"Everyone has their own expertise. For example, I do not understand politics or soccer, but I understand League of Legends. So, everyone can try to monetize in a particular field based on their accumulated knowledge. This is a place where the prediction market can attract outsiders very well and is also a very cool place in my opinion. Not to mention, everyone in real life likes to chat about various topics, which has given rise to jokes like 'I know everything.' The desire to prove oneself correct will make the prediction market more attractive to outsiders than cryptocurrency itself."

He believes that the future of the prediction market is limitless, and there is no problem with surpassing the number of users and funds during the peak of meme coins. Additionally, as more and more people enter the prediction market, new leaders will emerge, and different individuals will grow in their respective fields of expertise. Of course, there will be more and more 'scientists' who use news for sentiment arbitrage or other gameplay strategies.

「I believe that each stage has its own opportunities. In the past year and a half, the meme market was thriving, but now it's over. What we need to do is not dwell on past glories, let the past be the past. Whether you're a DeFi degenerate or a whale, an insider or an outsider, everyone will have their opportunities in the prediction market. Look forward to a new future.」

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

Bitcoin’s 7% Drop to $77K Might Indicate Cycle Low, Analyst Suggests

Key Takeaways: Bitcoin has experienced a significant drop from $77,000 to around $78,600 after a modest rebound. Analyst…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…