On his first day in office, Trump pardoned a veteran prisoner of the crypto community who had served 11 years.

No one understands better than Trump how to use political leverage to manipulate public sentiment.

Recently, Trump has been under some pressure. To circumvent presidential investment restrictions, on the eve of his inauguration in the "Goose City," the Trump family directly issued a coin to allow an entire interest group behind him to achieve "money for nothing" at the fastest speed.

There can be many people who harvest in the coin circle, but the one person who cannot be the president. Many members of the cryptocurrency community who once supported him openly opposed this behavior. However, there is another voice among those in the crypto community who are dissatisfied with Trump's coin issuance:

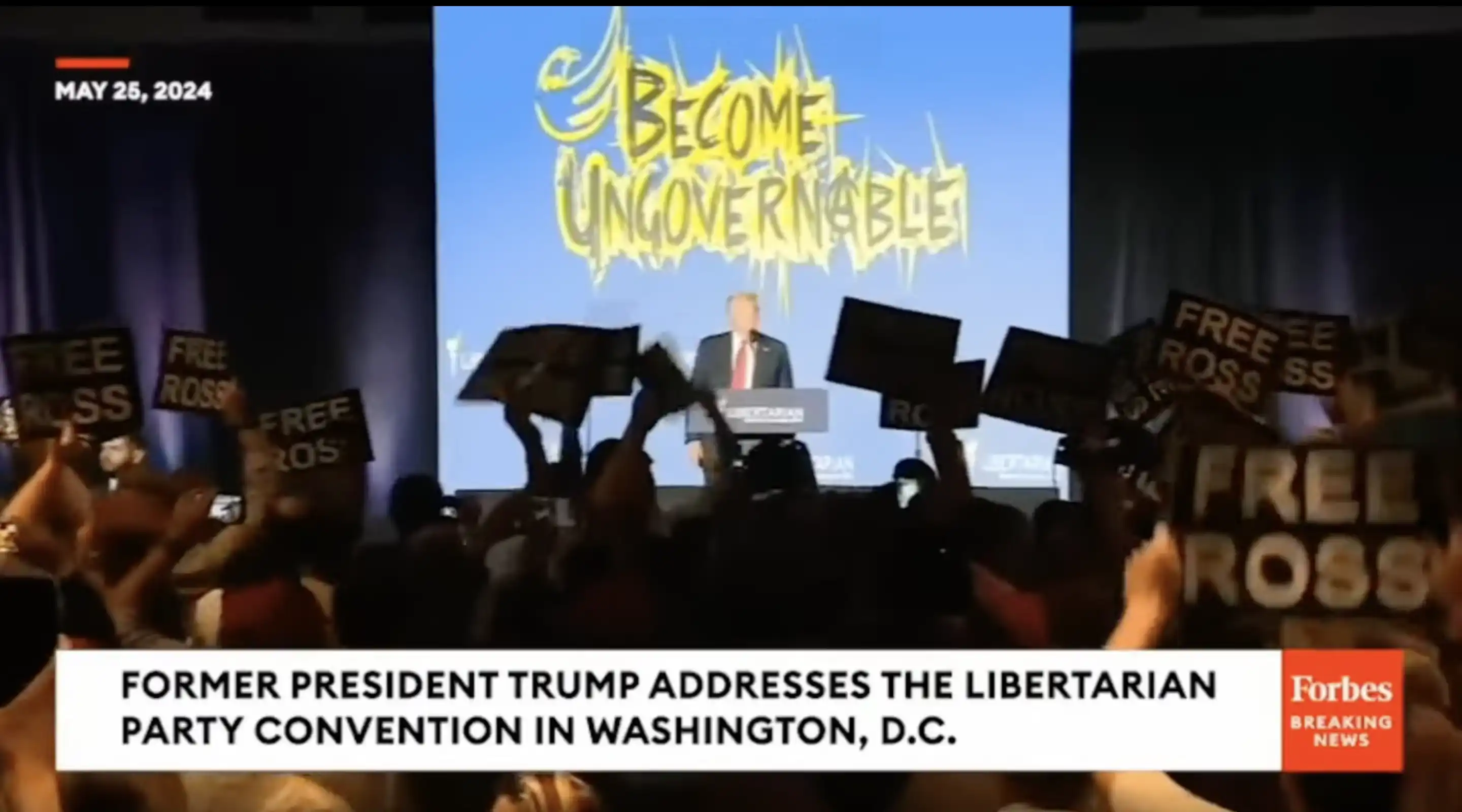

"I cannot forgive Trump for issuing a coin on the eve of his inauguration unless he releases Ross Ulbricht tomorrow."

This is a perfect example of Trump's sophisticated political maneuvering. Under pressure from the crypto industry, he immediately called the mother of Silk Road founder Ross Ulbricht and personally told the mother who has been waiting for her son to come home for ten years:

"I have just signed a full and unconditional pardon for your son Ross." Ross can come home.

This was Trump's promise during his campaign. He promised that if re-elected, he would grant clemency or even pardon Ross on his first day in office. Six months have passed since the Bitcoin 2024 Conference, and he has already fulfilled most of his promises at that time: firing the current SEC chairman Gray Gensler, appointing a Bitcoin/crypto presidential advisory committee, granting clemency or pardon to Ross, and establishing a strategic Bitcoin reserve for the U.S. government.

Every word and action seems to prove and imply that "I will fulfill all my promises made during the campaign one by one, and the next one may be the Bitcoin strategic reserve." The Bitcoin strategic reserve is undoubtedly the G-spot of the crypto industry. This way, Trump has dampened most of the crypto industry's anger over his coin issuance.

For those far removed from the crypto industry, it may be difficult to understand why releasing Ross could appease the crypto industry's anger over Trump issuing a coin that allowed the interest group to achieve 'money for nothing'.

This story dates back to 2011 when many significant events occurred, including the killing of Bin Laden and the death of Kim Jong Il. But there were also some events that didn't seem so important at the time, such as Bitcoin's birth just two years prior. Unlike now, when one is worth $100,000, in the first one or two years after its birth, Bitcoin stayed at $0.1 per coin.

While Bitcoin may now seem like a brilliantly designed system, at the time, it was seen as a useless design by many. It wasn't until 2010 that Ross heard about Bitcoin from a client, which became a turning point.

Ross Ulbricht

In 2011, Ross founded the infamous darknet market "Silk Road," which was not a marketplace for trading tea, silk, or porcelain. Instead, it became the most well-known and notorious darknet marketplace in history. The primary commodities traded on this website were drugs, sex slaves, child pornography, hitmen, arms deals, and fake identities.

Screenshot of the Silk Road website, image source: internet

To ensure anonymity, Ross designed the platform to be accessed only through the Tor onion router (search engines couldn't access it, and entry required special software) and conducted transactions solely in Bitcoin. The government's crackdown on illicit activities revolves around financial control, which is rooted in the banking system firmly held by the government. Bitcoin, on the other hand, is a payment tool divorced from the banking system—until now, banks and Bitcoin continue to coexist separately.

With the rise of Silk Road, Bitcoin finally found its first use case as a payment instrument for illicit transactions. Data shows that the Silk Road circulated over 9.5 million Bitcoins, which accounted for 80% of the circulating supply at that time.

To his real-life friends, Ross described his work as "building an economic simulator" with the aim of using economic theory to eliminate coercion and aggression between individuals, allowing people to experience what it's like to live in a world without systemic violence.

No one could have imagined that this seemingly sunny, ambitious young man was actually a major drug lord and the architect of the underground criminal world. However, there are no airtight walls in the world, as several regulatory agencies had their eyes on him, and even an FBI informant befriended him for a lengthy three-year period.

Ross once received an email from an FBI informant offering to buy him out for 1 billion dollars, image source: internet

The DEA already knew Ross's identity by following the network cable, and the FBI's arrest of him was also quite dramatic.

In October 2013, Ross was using a bookstore's Wi-Fi when the arrest happened. To prevent Ulbricht from deleting or encrypting files on his laptop, a pair of undercover agents posing as a couple walked past him and then loudly argued next to him.

With Ross distracted by curiosity, he turned to look at them, and at that moment, one agent swiftly took his laptop, while two other agents pounced on him. The agents inserted a USB device into the laptop and used software to copy key files, as Ross's laptop was logged into the "Silk Road" admin account at the time.

On August 21, 2014, Ross was officially charged with money laundering, computer hacking, and conspiracy to traffic narcotics. On February 4, 2015, he was found guilty on all charges. On May 29, 2015, the court sentenced Ross to double life imprisonment without parole for 40 years.

Undeniably, Ross was an extremely important figure in Bitcoin's development history. Just as Bitcoin was about to be overlooked by the world, he ended Bitcoin's history as a mere toy and gave it real-world significance — serving crime.

Just as the consensus of fools is still a consensus, the demand for the dark side is still a demand. Driven by illicit transactions, Bitcoin experienced its first major price surge, reaching $31 in June 2011. However, two months after Ross's arrest, Bitcoin soared to $1,100 per coin.

Due to the practice of liberalism, during Ross's 11 years in prison, there has continued to be broad support in society, including the cryptocurrency industry, for a more lenient treatment. Many in both parties also believe that Ross's sentence was unjust and that he should be given a second chance. Over 250 organizations, public figures, and leaders have expressed support, with over 600,000 people signing a petition for Ross's release.

Today, as times have changed, with Trump's election odds steadily rising on Polymarket (a highly accurate blockchain prediction platform), most people believe that Ross may be granted clemency or even a pardon.

Similarly, in the PolyMarket betting topic "Who will Trump pardon within the first 100 days in office?" there is a high likelihood of Ross being pardoned, with the odds of Ross's pardon steadily increasing. For a long time, Ross's probability of being pardoned was 73%.

A double life sentence plus 40 years on top was indeed too heavy for the young man who was just 26 years old at the time of his arrest.

Now, with the price of Bitcoin at $105,247, the United States has also welcomed its first "Bitcoin" president. Ross, who has been in prison for 11 years, is now 41 years old and as he walks out of prison, he can finally smile in front of the camera with ease.

First Photo of Ross Ulbricht After Pardon Revealed, Image Source BitcoinMagazine

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…