Investing Over $770 Million, Why Did Tether Invest in the Video Platform Rumble?

Original Article Title: "Why Did Tether Invest Over $775 Million in Video Platform Rumble? The Business Strategy Behind Trump's Circle"

Original Article Author: Nancy, PANews

On February 7th, the video-sharing platform Rumble announced that it had completed a $775 million strategic investment from Tether. Despite Tether, with annual profits in the billions, accelerating its investment pace over the past few months, this cross-sector investment in Rumble still came as a surprise.

The Opportunity Behind the Over $775 Million Strategic Investment

Since Rumble announced in December 2024 that it had reached a final agreement with Tether to receive a $775 million strategic investment, this investment and tender offer have officially been completed in recent days. As part of the transaction, Tether purchased 103,333,333 shares of Rumble Class A common stock at a price of $7.50 per share, totaling $775 million. Of this amount, $250 million will be used for growth initiatives, including attracting more content creators, strategic acquisitions, and enhancing the Rumble Cloud technology infrastructure.

As a video-sharing platform founded in 2013, Rumble has gained popularity among creators for advocating free speech, fairer revenue distribution, and attracting more copyright holders. It has also served as a haven against overregulation by traditional social media platforms. For example, during the 2024 U.S. presidential election, Rumble set a record with 1.79 million simultaneous online viewers, becoming a focal point for political discussions.

Regarding this investment, Rumble CEO Chris Pavlovski revealed in an interview with Barstool Sports founder Dave Portnoy that the investment will drive Rumble's global expansion, attract new creators, and redefine the meaning of a free speech platform. Pavlovski also mentioned the impact of Trump's election on Rumble's mission, believing that the collaboration with Tether will help Rumble expand globally, particularly in regions where free speech is suppressed. Integrating cryptocurrency will change how creators monetize their content, providing crypto-based tipping and payment options to further reduce reliance on centralized systems.

In addition to the reasons behind Tether's investment in Rumble, it may be related to the close ties between the two and Trump, as well as Tether's desire to expand its business presence in the United States.

Rumble has a deep relationship with former U.S. President Trump, and has even been dubbed the "Trump Concept Stock" by the outside world. As early as during the 2020 U.S. presidential election, Trump was banned from mainstream social media such as Facebook, Twitter, and YouTube. After losing his voice on social media, he began to shift to Rumble. At the same time, Trump also launched his own social platform, Truth Social, which used Rumble's video and streaming services at the time. It is worth mentioning that in addition to Trump, Narya Capital Management, the venture capital fund of former Vice President J.D. Vance, has also participated in Rumble's investment.

As Trump returns to power and a crypto-friendly policy environment in the U.S. attracts Tether's attention, Tether has made moves. In January of this year, Tether CEO Paolo Ardoino, in an interview with Bloomberg TV, pointed out that the improvement in the regulatory environment for the crypto industry, coupled with Tether's recent $775 million investment in the U.S.-listed company Rumble, has provided the company with an opportunity to reassess the U.S. market. However, he also emphasized that while not ruling out further entry into the U.S. market, it is necessary to wait for regulatory clarity and specific guidance, making the final decision based on the development of the U.S. legal framework.

Buying Bitcoin, Crypto Strategy Boosts Stock Price

Since the end of last year, Rumble has frequently appeared in the crypto field. In addition to receiving investment from Tether, Rumble has actively built up a Bitcoin reserve and launched a series of related crypto products.

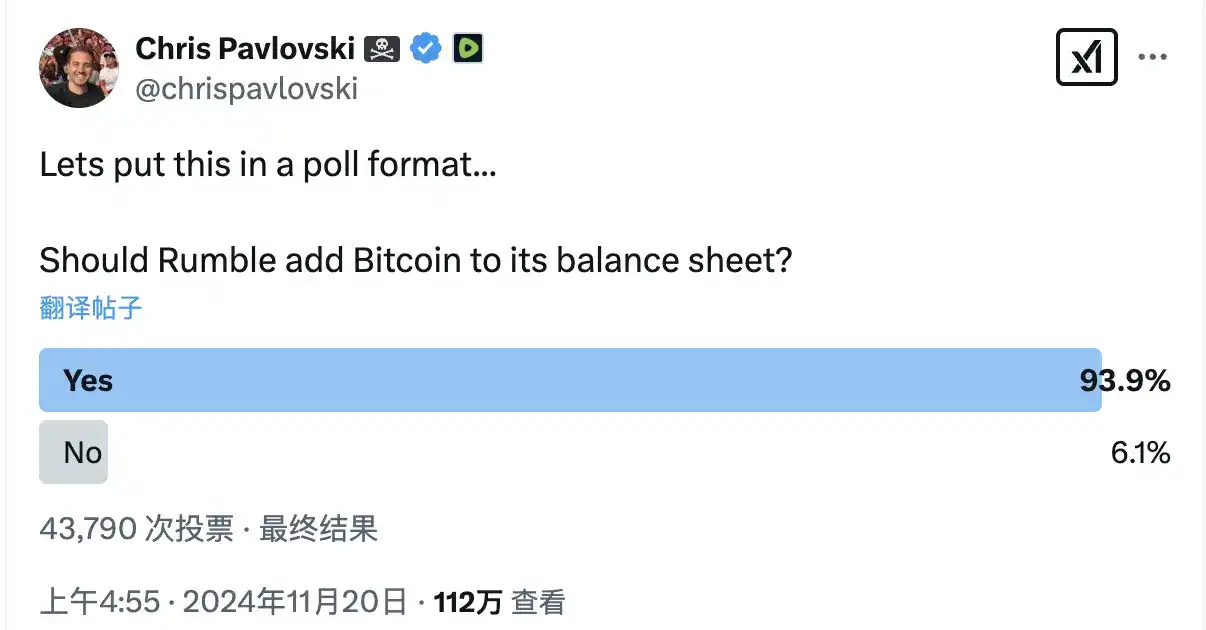

"Should Rumble add Bitcoin to its balance sheet?" In November 2024, Rumble CEO Chris Pavlovski initiated a vote on X, asking whether Bitcoin should be included in the company's balance sheet, receiving strong support.

Several days later, Rumble announced an investment of up to $20 million to purchase Bitcoin, as a key part of the company's financial diversification strategy, positioning Bitcoin as a strategic asset and inflation hedge tool.

At that time, Chris Pavlovski stated that Bitcoin is still in its early stages of adoption, and the crypto-friendly U.S. government policy and increasing institutional investor interest are accelerating this process. Unlike any government-issued currency, Bitcoin will not be diluted by endless printing, making it a valuable hedge against inflation and an excellent treasury supplement. The company plans to integrate cryptocurrency into its ecosystem, building a leading video and cloud service platform for the crypto community. Of course, Chris Pavlovski also indicated that this will not be the last time, hinting that the company may continue to increase its Bitcoin holdings in the future.

Back in January of this year, Rumble also announced the launch of the Rumble Wallet, a crypto wallet that supports Bitcoin and USDT, providing creators with a new way to transact. Creators can receive fan tips and subscription revenue in both cryptocurrencies. Paolo Ardoino, Tether's CEO, commented, "A cool feature of the Rumble Wallet is the use of an AI agent/assistant to help manage payments, suggest Bitcoin savings strategies based on past activity, and tip the most popular creators."

This series of crypto initiatives has had a positive impact on Rumble's stock price. According to Google Finance data, since Rumble announced its intention to adopt a Bitcoin treasury strategy, the company's stock price has skyrocketed, reaching a peak increase of 169.8%, briefly hitting a new all-time high of $16.27.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…