From VC Coins to the Meme Craze, the Cryptocurrency Market is Exhausted

Original Title: The People are Tired (of losing)

Original Author: francescoweb3, Head of castle labs

Original Translation: zhouzhou, BlockBeats

Editor's Note: This article delves deep into the changes in the crypto market, especially the fatigue experienced by retail users. It is easy to see the shift from a venture capitalist-dominated market at the beginning of 2024 to the meme coin frenzy. While meme coins initially provided retail investors with a more level playing field, they eventually became overly speculative, leading to a deteriorating market condition. Retail users are feeling tired due to losses, and the market has become fast-paced and competitive, emphasizing the importance of finding a new balance point and calling for more attention to projects with practical applications and fair distribution mechanisms.

The following is the original content (slightly reorganized for better comprehension):

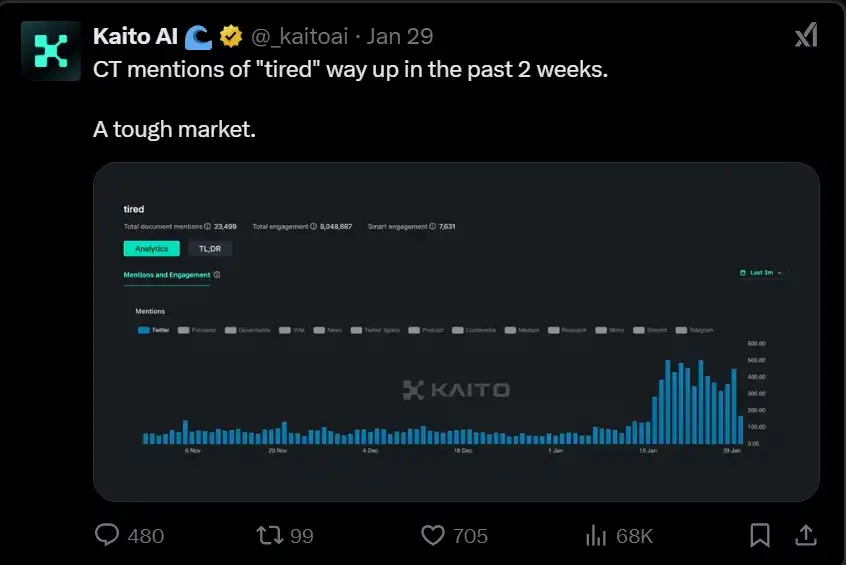

As Kaitoai emphasized, in the last two weeks of January 2025, the word "tired" saw an uptick in mentions on Crypto Twitter.

This cycle is different from others, more challenging, and even surprising traders who have been through two or three cycles before. The market is changing: the narrative shifts faster, and attention has become the scarcest currency. Last but equally important, there is increasing regulatory scrutiny and political intervention in the crypto space, bringing new variables.

Why Are People Feeling Fatigued?

Retail investors have missed out on too many opportunities, with the market dynamics changing faster each time what seems like the goal is within reach. In the 2021 cycle, we saw venture capitalists achieve exponential returns compared to retail investors without access to private investment opportunities.

All of this continued until around 2023 when projects like TIA and DYM were launched, signaling the end of retail investors' disillusionment with the technology being siphoned off to these venture capitalists.

What could be the most rational consequence of this? A movement seeking to change power dynamics.

The long-standing "Meme Coin" narrative gained more attention as venture capitalists no longer had private chips to dump on ignorant buyers in the market, benefiting retail investors who managed to find a level competitive environment. However, as the narrative became overplayed and saturated, the users' attention span further shortened. Let's look at how the market landscape has evolved and where we might be heading, attempting to explain why people are feeling fatigued.

Phase One (Early 2024) - From VC Coin to Meme Coin

It seems like a long time ago now, before the AI craze and the meme coin frenzy, there was a time when airdrops were the mainstream play for retail investors. This play was kick-started by Arbitrum and other Layer 2 airdrops. Retail users saw the potential of receiving airdrops by engaging with new protocols and chains, turning airdrops into a business, with the emergence of companies offering airdrop-as-a-service, and more.

However, the dream turned into a nightmare as these coins started to release and disclose their tokenomics, leaving users very disappointed: all that effort, and what was received through airdrops was almost nothing? One of the most controversial distributions was Scroll, which is a ZK-EVM L2.

After over a year of ecosystem promotion, the Scroll airdrop was very disappointing, with a concerning 5.5% of the SCR supply allocated to Binance instead of the community.

Furthermore, most of these tokens had very low circulating supplies (circulating supply/total supply), with a significant share allocated to VCs. Another topic of discussion was TIA and DYM, where at one point, these tokens' narratives on Crypto Twitter revolved around staking them in exchange for the expectation of future ecosystem project airdrops.

You guessed it: these airdrops never materialized, and the token prices only trended downwards (below is DYM's chart).

Here is an overview of the different rounds and investor unlocks for TIA:

In the initial unlock, over 97.5% of TIA's circulating supply was unlocked, valued at over $1.88, with a daily unlocking rate of 10 million dollars.

Ultimately, retail investors grew weary of these types of tokens, which meant that most tokens' issuance prices only saw a decline, eventually even dropping below their last fundraising round valuation.

This point becomes evident as we examine the dashboard provided below:

This dashboard considers the investment return of each VC's top-performing data-sample.

Venture capital returns from the previous cycle:

Venture capital returns from this cycle:

The end of the venture capital era was so apparent that even Hayes accurately pointed it out in his December 2024 article, at the end of the dark tunnel, retail investors saw a glimmer of hope: meme coins.

Tired of the venture capital-dominated conspiracy, retail investors could finally enter the permissionless market the blockchain was supposed to open up to.

That must be the way of the future, right?

Phase Two - The Meme Coin Craze

After the end of the venture capital era, users had to find a new play, and they discovered it through muststopmurad and his "meme coin supercycle."

For retail investors, meme coins seemed to be the closest thing to having an equal opportunity in the market—until they were no longer.

Prices soared, Trump was elected, and we were going to the moon.

But suddenly, the liquidity rug was pulled, and the market's attention shifted elsewhere, causing all your meme coins to collapse during market pullback.

Meanwhile, all the early insiders who had the opportunity to get in early also had the chance to offload their chips. Perhaps the situation retail investors ultimately faced was even worse than what they experienced with VC coins.

What remains now? A growing inclination towards risk-taking, a further shortening of attention spans, increased liquidity dispersion, all the while trying to understand past mistakes through more gambling disguised as "trades".

Pumpfun is just a symptom of the market's direction.

jediBlocmates highlighted the net negative issues in this ecosystem.

Among the reasons mentioned, the Pump.Fun team continues to move substantial amounts of fees out. In just last month, they moved over 880,877 SOL to Kraken, totaling 211,410,480.

The impact of meme coins and the Pump.Fun frenzy is evident in the market changes they bring: rapid narrative shifts, an environment resembling player versus player, and a lack of trust in anything anymore.

Phase Three - Post-Traumatic Market PTSD: People Feel Exhausted

Lost in the venture capital-risked risk investors, users now carry the trauma of the Pump.Fun arena, hoping their next 100x gains will make up for previous losses. The market has now permanently changed, and the new gameplay is a reflection of this change.

Market rotations are even more fleeting and rapid, where in previous cycles, you could hold a position overnight, hold tokens for weeks, and now, at most, you can only hold for days or hours. New projects siphon all liquidity: attention is scarce, everyone is playing the same game.

The influence of politics and regulations continues to grow: this was particularly evident in TRUMP's launch, highlighting how external events can have an unprecedented impact on the market.

Unfortunately, once again, retail investors have lost their way in this game, with many tokens becoming like the capital extraction mechanisms they have become all too familiar with. In contrast to this trend, the launch of Hyperliquidx has drawn attention to community-led airdrops and issuance. Over 31% of the airdrop was allocated to the community, and the token price has risen by over 7 times since launch, proving that fair distribution is achievable.

Nevertheless, it must be considered that not every project can replicate this model, as sustaining a project like Hyperliquid over a long period has already incurred tens of millions in massive expenses for the team.

Importantly, the launch of Hyperliquid has brought about a paradigm shift in the industry. Coupled with Kaito's release, the project's approach to launch strategy has also changed.

Where Does This Put Us?

These stages under consideration highlight two extremes:

1. Overwhelming power in the hands of venture capitalists: Retail investors cannot participate in private rounds and can only act as exit liquidity.

2. Unrestricted meme coin acquisition has led to a player-to-player market, deteriorating overall market conditions.

Both of these have the same consequences: retail investor dissatisfaction and a demand for balance and stability.

We leave some possible avenues to explore what the future might look like: a return to utility, reducing focus on meme coins, and more emphasis on practical projects.

Reducing the focus on value extraction, emphasizing value creation more, and avoiding zero-sum games. Returning to fair distribution, inspired by Hyperliquid.

A fresh transformation in protocol marketing and token launch methods, leveraging tools like Kaito for marketing, growth activities, and valuing the influence of social graphs and communities.

While we all know that price is the best marketing tool and has always been a key factor in attracting talent and liquidity, it would be a great loss if, amid an impending supportive regulatory environment, the focus remains solely on value extraction.

The growth cycle of emerging markets is often full of roller-coaster-like fluctuations, but it is crucial to have a final goal and outline a viable path for the majority. That is, building something truly valuable.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…