Deconstructing the AI Agent: How to Pioneer a New Era of DeFai?

Original Article Title: Autonomous Agents On-chain: From Chat to Action

Original Article Author: @jainargh, brahma.fi Lead

Original Article Translation: zhouzhou, BlockBeats

Editor's Note: AI Agents are gradually attracting market attention, despite facing challenges such as lack of research tools and user onboarding. This article explores the potential applications of agents in DeFi, including automated fund management, yield optimization, and risk control, while also looking forward to the broad prospects of future agent collaboration and innovation.

The following is the original content (slightly reorganized for better readability):

In today's crypto space, AI agents are still in the "chat" stage. They analyze tweets, make predictions, and tell you what to do—but that's about it. When you ask it to "swap ETH for USDC," you are actually just having a conversation with a large language model (LLM) that culminates in an API call. It's more like a cumbersome Telegram bot, and you end up being farmed.

We believe AI agents can do more. They should take autonomous actions, protect assets, and execute strategies without the need for constant intervention.

To achieve this, we are introducing ConsoleKit, offering developers:

Full-stack tools: Instantly deploy an agent or build an on-chain custom workflow.

Security-first execution capability: Achieved through the SAFE wallet and modular strategies.

Powerful programmability: Supporting the development of adaptive multi-agent systems for any chain or protocol.

How to Achieve On-chain Autonomous Agents?

Different developers have different frameworks, but we believe that the beginning of agent in DeFi is what we call a specialized agent, which runs a "workflow" based on a strategy (guardrail).

Specialized agents are systems optimized for specific protocols. They can autonomously execute workflows, enhance dApp interaction experience, help users efficiently deploy funds, manage risks, and protect on-chain assets, providing a smarter and more secure DeFi experience.

Imagine that when you deposit in Morpho, you no longer just see a static APY. Instead, you have an agent that can:

Real-Time Market Monitoring

Rebalance across different lending markets for optimal yield

While keeping you in full control

Our first implementation, Morphoagent, does just that and more. It goes beyond the traditional vault interface, injecting intelligence into each interaction. No more need to watch the market or hastily adjust your positions—the agent takes care of it all. Want more granular control? You can directly communicate with the agent. Unlike today's agents, when you say "rebalance to highest-yield pool," it actually happens. Every conversation translates into action.

How Does a Specialized Agent Work?

A Specialized Agent combines deterministic execution with adaptive intelligence to achieve on-chain autonomous operations.

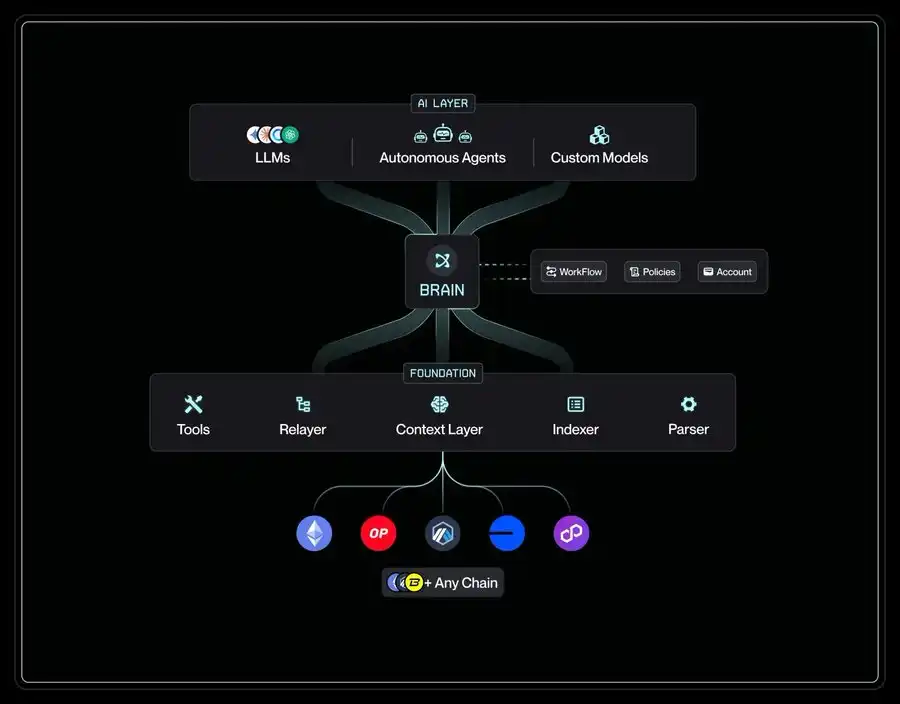

ConsoleKit Overview

AI Layer: Intelligence

LLM (Large Language Model): Formulates strategic decisions based on the following factors:

· User preferences and risk tolerance

· Market conditions and opportunities

· Historical performance patterns

RAG (Retrieval-Augmented Generation): Provides decision-making basis through the following:

· Protocol documents and mechanisms

· Past transaction records and outcomes

· Real-time market environment

Brain: Control

Workflow: Serializes operations into end-to-end strategies

· Deposit → Monitor → Rebalance process

· Multi-step position management

· Cross-chain operations

Account: safe-based

· Smart contract wallet

· Batch transactions

· Access control

Policy: Security Fence

· Transaction Limit

· Approved Protocols

· Risk Parameters

Foundation: Execution

· Tools: Core DeFi Operations

· Relayer: Transaction Relay

· Indexer: State Tracking

· Context: Market Data Flow

· Parser: Protocol Parsing

How It Works Together

Using Morpho Agent as an Example:

A Quick Process: Designed by Claude

A dedicated agent built on ConsoleKit's openness and modularity. Two SDKs have been released to developers:

1. Builder: Helps developers build complex workflows that agents can autonomously execute, providing strong execution guarantees.

2. Templates: Allow developers to easily add custom protocol tools.

ConsoleKit initially relies on battle-tested Relayers, Indexers, and Protocol Parsers, which have processed over $10 billion in transaction volume and manage over $3 billion in assets in Brahma Accounts.

What Does an Agent's Interface Look Like in DeFi?

(1) Embedded Agent

At first glance, the Morpho agent's interface looks no different from a regular DeFi vault—displaying APY, deposit amount, and rebalancing options. However, behind the scenes, each position is driven by a dedicated agent. It actively manages your funds using real-time market data, historical APY patterns, liquidity metrics, and Total Value Locked (TVL) trends.

1. Connect your regular EOA wallet.

2. ConsoleKit creates a secure smart account in the background (supported by SAFE).

3. Configure your risk preference and rebalancing parameters.

4. The agent actively manages your position within a strict policy fence.

5. Users retain custody of their assets.

Customize Your Strategy via Chat:

You: "I want to optimize yield, but I have a low risk preference."

Agent: "I will focus on stablecoin pools with TVL over 10 million USD. Currently, the best options are: Morpho-Aave USDC: 4.8% APY, TVL 50 million USD, Morpho-Compound USDT: 4.6% APY, TVL 45 million USD. Would you like to set any other preferences?"

You: "Yes, only use Gauntlet-selected vaults and rebalance weekly."

Agent: "Understood. I will optimize yield in Gauntlet-selected vaults, rebalance weekly on Mondays, while maintaining your risk parameters."

(2) Meeting Users Where They Are: The Fusion of Agent and DeFi

We envision a future where developers can leverage ConsoleKit to build millions of dedicated agents for public goods like Aave, Uniswap, and Morpho. Anyone can create an agent to help users interact more efficiently with these protocols—from optimizing yield on Aave to managing liquidity positions on Uniswap. These agents do not rely on a single user interface but exist wherever users need them, making DeFi more convenient and efficient.

Imagine a user who wants to provide assets on Aave and engage in borrowing. Instead of manually managing multiple steps, they can let a dedicated Aave agent seamlessly batch process transactions. Moreover, this agent can set triggers based on the user's health factor, actively manage risk, and prevent liquidation.

Developers can embed agents directly into wallet interfaces, whether through mobile apps or browser extensions, to offer users a smarter interactive experience. With ConsoleKit, agents can meet user needs anytime, anywhere, making DeFi smarter, more secure, and easier to use.

The Future of DeFi Agents

Users can seamlessly interact with a dedicated agent built on ConsoleKit, deploying funds or configuring workflows with just one click, all while retaining full asset ownership through safe practices. The on-chain complexities—such as cross-chain transactions, real-time decision-making, or protocol integrations—are abstracted away, allowing users to harness DeFi with simple yet powerful tools. As a trusted executor, the agent strictly follows instructions without taking over asset custody.

For developers, ConsoleKit simplifies the creation and deployment of agents with minimal code, enabling developers to focus on building interfaces and workflows. ConsoleKit ensures that agents support multi-chain functionality, connect to all major protocols, and can execute reliably. Protocol teams can embed dedicated agents into their dApps or build new interfaces, enhancing user experience and unlocking new possibilities.

In the future, millions of dedicated agents will be built on public goods such as Aave, Uniswap, Morpho, and Hyperliquid, with each agent autonomously performing specific tasks. These agents will collaborate—sharing insights, pooling resources, and optimizing outcomes. For example, a Morpho agent optimizing yield can collaborate with an Aave agent to manage collateral, while a Uniswap agent handles liquidity provision, collectively improving efficiency and risk management.

As agents continue to evolve, they will collaborate in a "swarm" form, creating new financial experiences and primitives. These swarms will accomplish workflows that individual agents cannot, such as managing decentralized treasuries, building yield strategies, and adjusting market conditions based on user demand. This future composed of interconnected agents is rapidly approaching, bringing a more intelligent and cooperative experience to DeFi.

You may also like

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…

White House Continues to Negotiate Over Crypto Market Structure Bill

Key Takeaways The White House is pushing for a compromise on the contentious issue of stablecoin yields in…

Billionaire Michael Saylor’s Strategy Acquires $75M More Bitcoin – Is This a Bullish Sign?

Key Takeaways Michael Saylor’s Strategy has expanded its Bitcoin holdings by purchasing an additional 855 BTC for $75.3…

Polymarket Bettors Assign Over 70% Probability of Bitcoin Dropping Below $65K — Are They Correct?

Key Takeaways Polymarket users predict Bitcoin has a 71% chance of falling below $65,000 in 2026, reflecting market…

CFTC Regulatory Shift Could Unlock New Growth for Coinbase Prediction Markets

Key Takeaways Newly appointed CFTC Chair, Michael Selig, aims for a unified federal oversight approach for crypto-linked prediction…

We Hacked Perplexity AI to Predict the Price of XRP, Bitcoin, and Ethereum By the End of 2026

Key Takeaways Perplexity AI predicts XRP may soar to $8 by 2026, fueled by legal victories and supportive…

Current Crypto Price Predictions: An In-Depth Analysis of XRP, Dogecoin, and Shiba Inu

Key Takeaways XRP, Dogecoin, and Shiba Inu are experiencing significant price declines amid geopolitical uncertainties and general market…

Pepe Coin Forecast: Price Appears Dismal, Yet Savvy Investors Rally Behind the Scenes

Key Takeaways Pepe Coin has experienced significant price drops, yet indicators suggest it may soon bottom out, with…

BitMine Reports 4.285M ETH Holdings, Expands Staked Position With Massive Reward Outlook

Key Takeaways BitMine Immersion Technologies has reported significant crypto holdings valued at $10.7 billion. The company’s Ethereum holdings…

Crypto Exchanges’ Stock Plunge 60% as Trading Volumes Dwindle – Is the Decline Ending or Just Beginning?

Key Takeaways Trading volumes on major crypto exchanges have drastically fallen, with a nearly 90% drop from October…

Best Crypto to Acquire Now February 2 – XRP, Solana, Ethereum

Key Takeaways Recent market turmoil saw Bitcoin plunge dramatically, affecting all major cryptocurrencies. XRP, Solana, and Ethereum are…

Ethereum Price Prediction: Top ETH Bulls Face $7.6 Billion in Paper Losses as Price Drops Below $2,400

Key Takeaways Ethereum has faced a downturn, dropping 19% below $2,400, resulting in significant paper losses for major…

Shiba Inu Price Prediction: SHIB Just Crashed to a 3-Year Low – Is SHIB Heading Towards Zero?

Key Takeaways Shiba Inu has recently hit a significant low, experiencing a 15% drop that places it at…

Trump Says He Was Unaware of $500M UAE Investment in World Liberty Financial

Key Takeaways: US President Donald Trump denied knowledge of a $500 million UAE investment in World Liberty Financial.…

Crypto Industry and Banks at a Stalemate Over Stablecoin Yield Deal

Key Takeaways The White House has urged a compromise on stablecoin yields to progress Senate crypto legislation. Crypto…

Why Vitalik Buterin Sold Over 700 Ethereum (ETH) Despite Market Recovery

Key Takeaways Vitalik Buterin sold over 700 Ethereum not for market reasons but to finance long-term projects. The…

Binance Withdrawals Restored Following Temporary Disruption

Key Takeaways Binance faced technical difficulties affecting withdrawals, but services were quickly restored within 20 minutes. The disruption…

Asian Markets Stabilize as Bitcoin Trades Around $78K

Key Takeaways Bitcoin steadies at approximately $78,000 as Asian markets recover from recent volatility. Regional equities, including Japan’s…

Bitcoin Price Prediction: The Warsh Shock & The Stablecoin Summit—Is the Bull Case Dead?

Key Takeaways Kevin Warsh’s nomination as Federal Reserve Chair has caused a drop in liquidity for riskier assets,…