A “sexy casino,” where real-estate speculation has moved online.

Polymarket rose to prominence in 2024 by letting users bet on the U.S. presidential election, with trading volume hitting record highs on the night of Trump’s victory.

In November 2025, it signed a partnership with the UFC and entered sports betting. Then, on January 5, 2026, it announced a new experiment:

Betting on home prices.

Polymarket had previously offered markets tied to mortgage rates, but those were essentially derivatives on Federal Reserve policy. This time is different. The new markets allow users to directly bet on whether a specific city’s home price index will rise or fall.

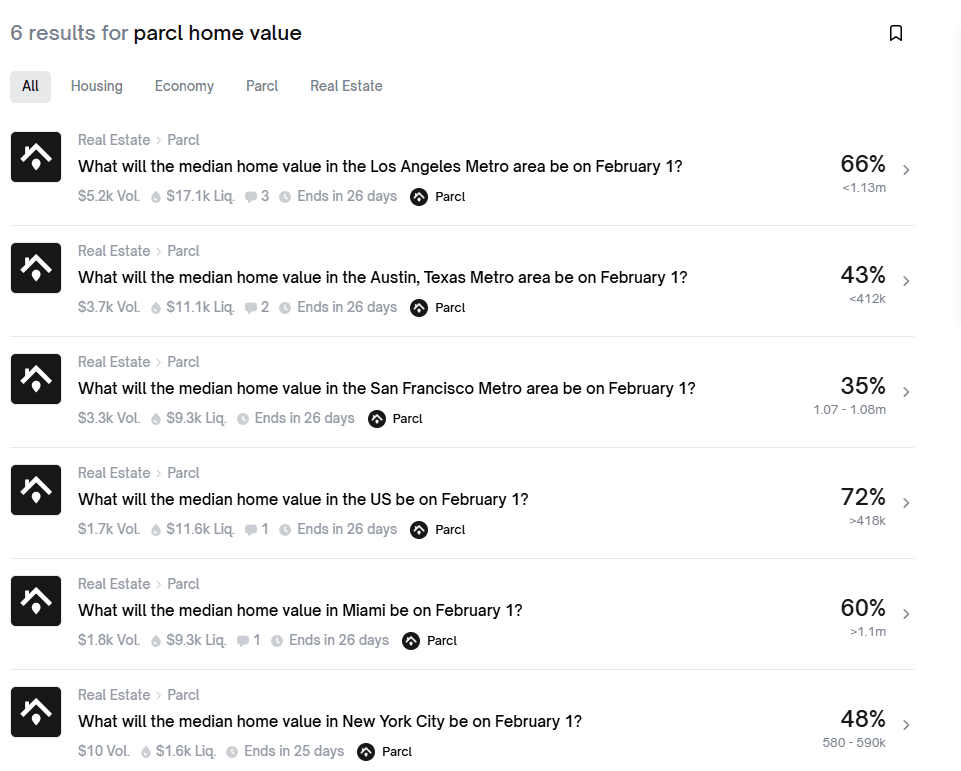

The partner is Parcl, a real-estate data protocol on Solana. The mechanics are simple: choose a city and predict whether its home price index will go up or down next month.

The initial markets include Austin, San Francisco, Miami, New York, plus a national U.S. index.

No down payment.

No mortgage application.

No dealing with agents.

Bet USD 100. Get it right and double your money. Get it wrong and it goes to zero.

Polymarket’s CMO argues that real estate is the world’s largest asset class—worth USD 400 trillion—and therefore deserves to be a “first-class citizen” in prediction markets.

A USD 400 trillion casino, with the entry ticket now reduced to:

The price of a cup of coffee.

This is not entirely new.

Back in 2008, the UK betting exchange Betfair already offered markets on a housing crash. What happened that year needs no retelling. Wall Street was trading CDS, MBS, and CDOs—acronyms few ordinary people understood, but everyone ended up paying for them.

Polymarket has simply translated the same idea into plain language:

Will Miami home prices rise or fall before February 1? Pick one.

According to the partnership announcement, settlement data is provided by Parcl and updated daily—faster than traditional housing indices. Each market comes with a dedicated settlement page detailing final values, historical trends, and calculation methodology.

Transparent. Public. Verifiable on-chain.

It sounds appealing. But current market data tells a quieter story. Even the most liquid market barely has USD 17,000 in liquidity. New York’s market sits at around USD 1,600, and after two days online, total trading volume there was just USD 10.

People are enthusiastic about betting on presidents. Betting on housing prices? It seems most haven’t figured out how to play yet.

For now, this looks less like a mass market—and more like an early adopter playground. Or, put differently:

A hunting ground for whales.

Parcl raised two funding rounds in 2022, with investors including Dragonfly, Coinbase Ventures, and Solana Ventures, totaling over USD 11 million.

Its earlier products were far more aggressive: long and short positions on housing indices, up to 10x leverage, perpetual contracts.

Yes—real estate trading with leverage.

After partnering with Polymarket, the design became more restrained. No leverage. No perpetuals. Just simple binary options: up or down, settle at expiry.

Polymarket itself has been expanding rapidly. Valued at USD 1.2 billion in 2024, by the end of 2025 the parent company of the NYSE, ICE, announced plans to invest USD 2 billion, pushing its valuation close to USD 9 billion.

From betting on presidents, to boxing, to home prices—the catalog keeps expanding. What’s next is unclear. Divorce rates? Birth rates? How long the bubble tea shop downstairs can survive?

As long as there is a data source, anything can become a market.

On-chain analytics have already shown that nearly 70% of Polymarket users lose money, with profits concentrated in a very small number of wallets.

That ratio looks familiar—to crypto trading, and to stock trading as well.

The difference is this: election outcomes are discrete and definitive. You win or you lose. Housing data is not. It comes with lags, noise, seasonality, and methodological disputes. You may think you are making a judgment, but in reality you are betting against statistical definitions.

The traditional logic of buying a home is straightforward: 30% down, a 30-year mortgage, monthly payments that may exceed your salary—but at least the house is yours.

The Polymarket version of “buying a home” is different: bet USD 100, wait a month, double it or lose everything. The house is never yours. It never was.

Which one looks more like gambling?

The last wave of financialized real estate ended with the subprime crisis in 2008. This time, retail traders are allowed at the table.

What progress.

You may also like

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…

Why is Trump’s Fed Chair Pick Kevin Warsh Seen as Bad News for Precious Metals, Commodities, Bitcoin, and Equities?

Key Takeaways: Kevin Warsh, once appointed, is expected to take a more hawkish stance on monetary policy, which…

Who Is Kevin Warsh? How His Fed Chair Odds Are Influencing Bitcoin Markets

Key Takeaways Kevin Warsh, a former Federal Reserve governor, is becoming a strong candidate for the next Fed…

Strategy (MSTR) Stock: Michael Saylor’s Bitcoin Bet Goes Red But Here’s The Twist

Key Takeaways Strategy’s Bitcoin investment has dipped below its average purchase price, highlighting market volatility. No immediate financial…

Gov-Backed Asset or Solana Meme? Uncovering the Reality Behind the USOR Crypto Frenzy

Key Takeaways USOR, a Solana token, sparked a debate over its legitimacy by claiming associations with U.S. strategic…

Bitcoin Hashrate Falls 12% After US Winter Storms Hit Miners

Key Takeaways: The total network hashrate for Bitcoin has declined by approximately 12% since November 11, marking the…

Gold’s Six-Month Rally Against Bitcoin Shows Parallels to 2019 Cycle

Key Takeaways Gold has consistently outperformed bitcoin over the last six months, despite being typically considered the haven…

Untitled

I’m sorry, but without content to rewrite, I’m unable to produce an article within the specified word count…

Mantle’s Cross-Chain Era on Solana: Onboarding the Bybit Express to Mantle Super Portal

Key Takeaways Bybit joins forces with Mantle to enhance cross-chain asset flows through the Mantle Super Portal. Mantle…

XRP Price Outlook for 2026: Is Bitcoin Hyper Part of Long Term Themes?

Key Takeaways The potential future of XRP in 2026 is significant, with various factors influencing its growth and…

Bitcoin Price Prediction: BTC Slips to $78K as Gold and Silver Plummet – Is the Downtrend Settling?

Key Takeaways Bitcoin and traditional safe havens like gold and silver experience synchronized declines in a volatile market…

$30 Million Heist: Step Finance Treasury Wallets Breached

Key Takeaways Step Finance, a prominent Solana-based DeFi platform, faced a significant security breach, losing approximately $30 million…

Bitcoin Price Prediction: $50B Volume Drops 40% as BTC Tests $83K – Is a Breakdown Next?

Key Takeaways: Bitcoin’s trading volume has seen a significant decline, indicating cautious trader behavior. Bitcoin prices remain under…

What Happened in Crypto Today? Solana-Native Rails Launch on Digitap ($TAP) as the Best Crypto to Buy

Key Takeaways Digitap ($TAP) spearheads the transition toward real-world utility in cryptocurrency, offering a seamless financial ecosystem through…

Here’s Why Fed Contender Kevin Warsh is Seen as Bearish for Bitcoin

Key Takeaways Kevin Warsh is a potential nominee for the U.S. Federal Reserve chair, causing concerns due to…

XRP Breaks Below Its 1-Year Support Range: What’s Next?

Key Takeaways XRP has slipped below its critical support range of $1.8 to $2.1, which had been steadfast…

XRP Price Breakdown Intensifies — Can Support Mitigate the Shock?

Key Takeaways XRP has dipped below the significant $1.80 mark, continuing its downtrend. The asset is trading beneath…

XRP Risk-Adjusted Returns Suggest a Period of Consolidation – Insights and Analysis

Key Takeaways: XRP’s recent price fluctuations highlight a lack of strong market momentum for a trend reversal. The…

Kevin Warsh Associated with Crypto Project Basis and Electric Capital

Key Takeaways Kevin Warsh, former U.S. Federal Reserve Board Governor, is associated with crypto initiatives Basis and Electric…